Why Do You Need an Auto Insurance Card?

Driving requires skill, caution, and compliance with legal requirements — including proof of auto insurance. An auto insurance card isn't just a good idea. It's a legal requirement in most jurisdictions. This mandate ensures that all drivers have at least the minimum liability coverage required by law. The essence of this requirement is safety and responsibility; it's about ensuring that all drivers can be held accountable for potential damage or injury they may cause while operating a vehicle.

The law's stance on carrying an auto insurance card is clear: it's essential for every driver. This card is a tangible verification of your insurance policy, proving to law enforcement and other parties that you meet the minimum insurance coverage standards. Without this proof, you could face various penalties ranging from fines and vehicle impoundment to license suspension, depending on the jurisdiction.

The practical benefits of having your auto insurance card readily accessible are significant. During traffic stops, presenting your insurance card can facilitate a smoother interaction with law enforcement, immediately demonstrating compliance with insurance laws. In the unfortunate event of a vehicle accident, having your insurance information on hand allows for a swift exchange of details with the other party involved, streamlining the initial steps toward claims and repairs.

Furthermore, providing proof of insurance is often a requisite step in vehicle registration or renewal. Having your auto insurance card ready can expedite these administrative tasks, saving you time and hassle. This ease of access to your insurance information helps fulfill legal and procedural requirements and contributes to a more organized and less stressful driving experience.

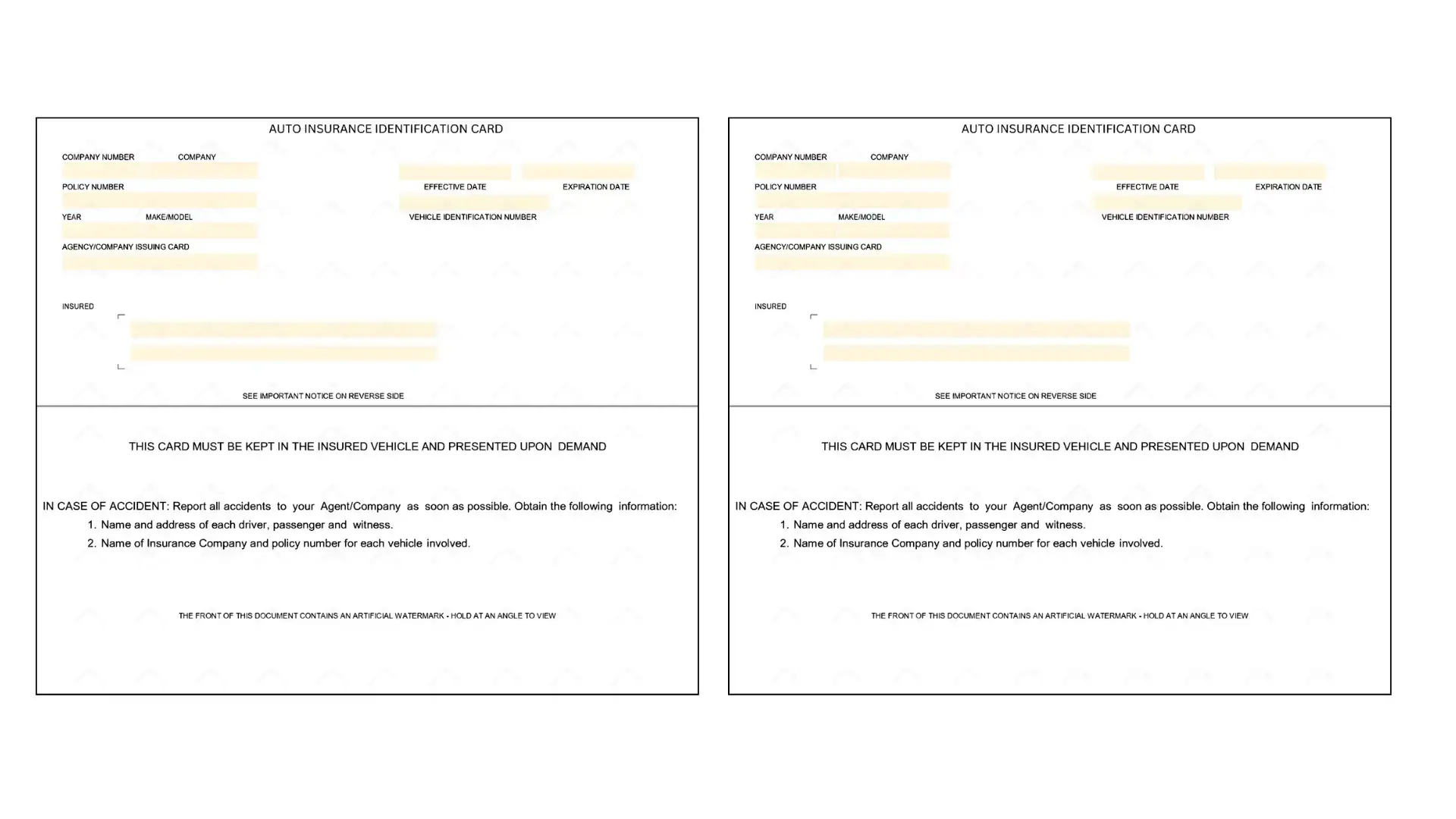

Information Included on Auto Insurance Card Template

More than just a piece of plastic or a digital document, a car insurance card is a compact summary of your policy's most important details. It also provides the necessary information, from a routine traffic stop to the stressful moments following an accident. Understanding what each field on your card means can significantly boost your confidence as a driver. Here's a breakdown of the most critical information found on car insurance cards:

- Policy number. This is the unique identifier for your insurance policy. You'll use it when you need to file a claim or inquire about your coverage with your insurance provider.

- Policy dates. These dates indicate the start and end of your insurance coverage period, helping you track when to renew your policy.

- Insured vehicles. This section includes the make, model, and vehicle identification number (VIN) of each vehicle covered under your policy, confirming that your insurance applies to the cars you're driving.

- Policyholder’s full name. It lists the name of the person or entity to whom the policy is issued, verifying who is insured to drive the covered vehicles.

- Insurance company details. This section provides the contact information for your insurance provider, including phone numbers and websites, so you can easily reach them when necessary.

Each element ensures that your auto insurance card serves its purpose effectively. The policy number and policyholder's name authenticate your relationship with the insurance company, while the policy dates keep you informed about the duration of your coverage. The detailed listing of insured vehicles ensures that you have proof of insurance for the specific cars you drive. Lastly, having your insurance company's contact details at your fingertips simplifies getting assistance, whether filing a claim or seeking answers to policy-related questions.

Why Use Car Insurance Card Template?

A progressive insurance card template can offer numerous benefits for drivers, vehicle owners, and insurance providers. It simplifies generating proof of insurance, ensuring all necessary information is presented clearly and efficiently.

A template guarantees that every car insurance card contains all the required information, laid out consistently. This uniformity helps the insured and those needing to verify insurance details (like law enforcement or other drivers in the case of an accident) find information quickly and easily. Moreover, a fillable auto insurance template can be designed to comply with state or regional regulations regarding what information must be included on an insurance card. It helps prevent legal issues related to insufficient proof of insurance.

With an auto insurance card template, any insurance company can quickly issue cards to their policyholders, speeding up the onboarding process. A standardized format for the insured means easier access to their information when needed. Also, many drivers prefer to keep a digital copy of their car insurance card on their mobile devices. Templates make creating digital versions that are readable on various screens easier.

So, using an auto insurance card template provides a practical and effective way to manage evidence of insurance. It complies with regulatory requirements, improves convenience, promotes professionalism, and encourages environmental sustainability. For drivers, it means having dependable, easy-to-use evidence of insurance at their fingertips, which may significantly decrease stress and improve the experience of storing and presenting insurance information.

Filling Out Auto Insurance Card Template

By carefully completing each section of the auto insurance card, you ensure that all necessary details are accurately documented. This card serves as proof of insurance coverage for your vehicle and must be kept in the insured vehicle at all times, ready to be presented upon demand.

Step 1. Company Number and State

Begin by entering the insurance company number, typically provided by your insurer. This number uniquely identifies your insurance provider. Following this, specify the state for which the insurance card is issued.

Step 2. Year, Make, and Model

Specify the year, make, and model of your insured vehicle. This information helps identify the insured vehicle and is essential in the event of a claim or insurance verification during traffic stops.

Step 3. Agency/Company Issuing Card

Write the name of the agency or company branch that issued your insurance card. It could be the local office of your insurance provider or the specific agent who handles your policy.

Step 4. Insured

Enter the insured individual's name exactly as it appears on your insurance policy. This typically will be the vehicle owner or the primary driver insured under the policy.

Step 5. Insurance Identification Card Information

Input the start date of your insurance coverage. This date signifies when your insurance protection begins. Then, Write the unique VIN of your insured vehicle. The VIN is crucial for insurance purposes, as it precisely identifies the vehicle covered under the policy. Also, enter the date your current insurance policy expires. It's crucial to ensure the coverage is renewed on time to avoid lapses in insurance protection.

Step 6. Important Notices and Instructions

Review the reverse side (the second page) of the auto insurance card template for any important notices or instructions provided. These may include guidance on what to do in the event of an accident or other important policy details.

Step 7. Verify and Save

Double-check each field you’ve updated to ensure its accuracy. After verifying the information, save and download the document. Print a clear copy of the auto insurance card template if needed, or ensure the digital version is saved in an easily accessible but secure location on your device.

Tips for Keeping Your Auto Insurance Card Accessible

One of the most convenient ways to keep your auto insurance card accessible is through digital storage solutions. Many insurance companies offer mobile apps to access a digital version of your insurance card. Alternatively, you can store the digital card in a digital wallet on your smartphone. This method ensures that your insurance card is always with you as long as you have your phone. Additionally, digital copies are easy to share electronically if you can quickly provide proof of insurance to authorities or involved parties after an accident.

Despite the convenience of digital options, having physical copies of your auto insurance card is still important. Keep one copy in your vehicle, preferably in the glove compartment or another secure spot where you can easily retrieve it. It's also wise to keep another copy safe at home, such as with other essential documents. This ensures you have a backup in case your digital copy is inaccessible or your phone's battery is depleted.

Auto insurance policies are subject to changes and renewals. Whenever your policy is updated or renewed, you must replace your auto insurance card with the most current version. It applies to both digital and physical copies. Regular updates ensure that the information on your card accurately reflects your current policy status, including coverage dates and policy numbers. Updating your insurance card helps avoid potential complications or misunderstandings during traffic stops or after an incident.

Related Posts

Visit the links below for comprehensive guides and helpful information to stay informed and ensure you have the essential documents for your auto insurance needs:

- The Main Types Of Car Insurance Explained

- State-Specific Requirements for Auto Insurance

- Legal Risks of Not Carrying an Auto Insurance Card

- Digital vs. Physical Auto Insurance Cards: Legality Issues

- Handling Traffic Stops Without an Auto Insurance Card

- Lost Your Auto Insurance Card? Steps to Take Immediately

- Fake Auto Insurance Cards: The Legal Consequences

- Auto Insurance Cards and Rental Cars: What You Need to Know

- Auto Insurance Abroad: Know Your Coverage

- Liability vs. Comprehensive Auto Insurance: What's the Difference?

- Why Uninsured Motorist Coverage Is Essential?

- The Role of Deductibles in Auto Insurance

- How to File an Auto Insurance Claim: A Step-by-Step Guide

- Top Factors Affecting Your Auto Insurance Rates

- The Impact of Traffic Violations on Auto Insurance Rates

- Auto Insurance for High-Risk Drivers: What You Need to Know

- Temporary Auto Insurance: When You Need It

- Gap Insurance: Closing the Value Gap in Auto Loans

- Insurance for Ride-Sharing: Uber, Lyft, and More

- Insurance for Electric Vehicles: What's Different?

- Auto Insurance Discounts You May Be Missing Out On

- Tips for Lowering Your Auto Insurance Premiums

- How to Choose the Best Car Insurance Provider?